Why Sector Rotation Stock Market Moves Require Index Alignment for Confirmation

- Sep 3, 2025

- 8 min read

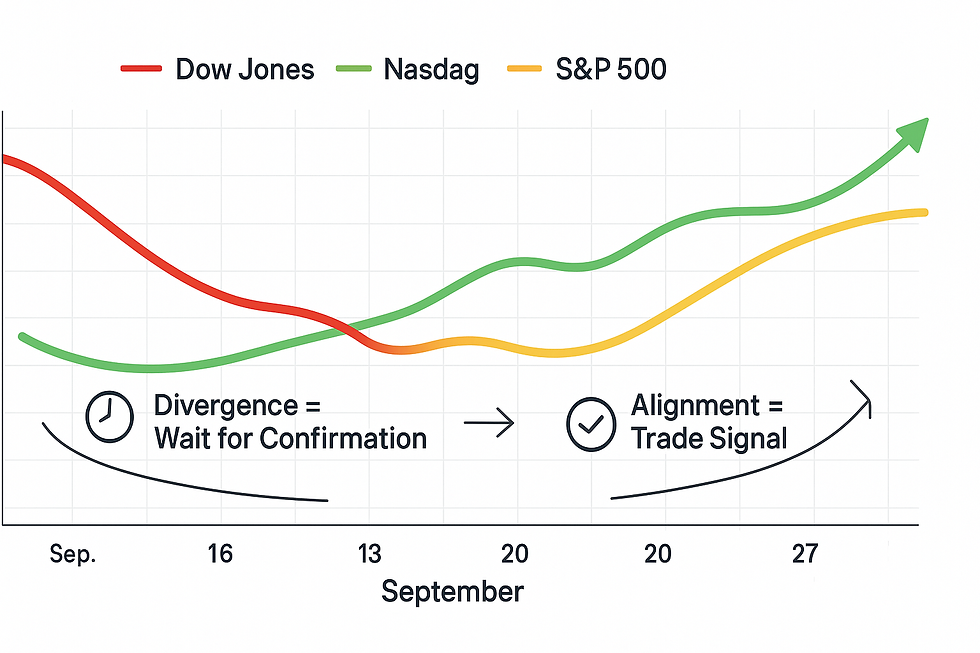

Understanding sector rotation stock market dynamics requires more than recognizing which sectors outperform during specific periods. True sector rotation analysis demands systematic confirmation through multiple index alignment rather than isolated sector strength or weakness. Steve's current market commentary demonstrates this principle through the divergence between Nasdaq tech leadership and Dow industrial weakness, showing why patience for proper alignment creates superior trading opportunities.

Current market conditions reveal classic sector rotation patterns, with technology showing resilience while industrials and cyclicals face pressure from rising bond yields. However, this divergence represents incomplete rotation rather than confirmed sector leadership change. Without alignment across major indices, these moves often prove temporary and unreliable for systematic positioning decisions.

Professional traders understand that sustainable sector rotation requires institutional confirmation across multiple market segments simultaneously. This systematic approach prevents premature positioning based on isolated sector movements that lack broader market support and structural validation through proper cycle timing methodology.

The Foundation of Systematic Sector Rotation Analysis

Sector rotation stock market analysis begins with understanding that individual sector moves mean little without broader market context and confirmation signals. Steve's commentary highlights how Nasdaq strength driven by Alphabet's 6% premarket gain represents isolated news-driven movement rather than systematic sector rotation that institutional money can sustain over meaningful time periods.

Effective sector rotation analysis requires examining cycle projections across multiple indices to determine whether apparent sector leadership changes reflect genuine institutional positioning or temporary technical factors. The current divergence shows Nasdaq cycles projecting continued strength while Dow cycles indicate sharper decline into September 17th, creating mixed signals that demand patience rather than aggressive sector positioning.

The foundation of systematic sector rotation involves recognizing that sustainable leadership changes require alignment between news catalysts, cycle timing, and institutional flow patterns. Without this confluence, sector moves typically reverse quickly, leaving traders positioned in temporary strength that lacks structural support for extended periods. Check our post on Market Rate Meaning: How Interest Rates Shape Economic Cycles and Market Behavior for more info.

How Index Divergence Reveals Incomplete Sector Rotation

Index divergence patterns provide critical insights into sector rotation completeness that surface-level sector analysis cannot capture. Steve's analysis reveals how tech leadership through Nasdaq strength occurs alongside industrial weakness in the Dow, but this divergence indicates incomplete rotation rather than confirmed sector leadership transition requiring systematic positioning adjustments.

Professional sector rotation analysis recognizes that true rotation involves money flowing from one sector group into another, creating simultaneous strength and weakness patterns that align across major indices. Current conditions show technology attracting flow while industrials face pressure from rising yields, but without S&P confirmation, this pattern lacks the institutional validation necessary for sustained sector leadership.

The divergence also demonstrates why waiting for index alignment prevents premature sector positioning that appears logical but lacks systematic support. When indices point in different directions, sector rotation remains incomplete, requiring patience until broader confirmation emerges through cycle alignment and institutional flow validation across multiple market segments.

Treasury Yield Impact on Sector Rotation Validation

Rising treasury yields create sector rotation pressures that require systematic analysis rather than reactive positioning based on immediate sector responses to yield changes. Steve's commentary shows how 30-year Treasury and gilt yields reaching multi-decade highs affect different sectors differently, with industrials and financials facing borrowing cost pressures while technology maintains relative strength through different fundamental drivers.

Yield-driven sector rotation must be evaluated through cycle timing frameworks that determine whether interest rate pressures align with projected institutional positioning changes or represent temporary technical factors. Current yield levels suggest structural pressure on rate-sensitive sectors, but without corresponding cycle confirmation across indices, these pressures may not translate into sustainable sector leadership transitions.

The systematic approach to yield-driven sector rotation involves monitoring whether rising rates align with projected cycle timing and institutional flow patterns rather than assuming that yield changes automatically create sector rotation opportunities. This disciplined analysis prevents positioning in sectors that face fundamental pressures without corresponding cycle support for sustained moves.

Economic Data Influence on Sector Rotation Timing

Economic calendar events create sector rotation catalysts that require systematic evaluation through cycle alignment rather than immediate reactive positioning based on data releases. Steve's commentary identifies JOLTS job openings, factory orders, and Fed Beige Book as potential sector rotation drivers, with Friday's payrolls representing the larger systematic catalyst for institutional positioning changes.

Sector rotation driven by economic data must be evaluated through the lens of existing cycle projections and index alignment patterns rather than isolated data interpretation. Labor market strength or weakness affects different sectors differently, but without cycle confirmation, data-driven sector moves often prove temporary and unreliable for systematic positioning decisions.

The timing of economic data releases relative to projected cycle lows and index alignment patterns determines whether sector rotation based on fundamental data has structural support or represents noise within existing trends. This systematic approach prevents chasing sector moves that appear logical based on data but lack cycle confirmation and institutional flow validation.

Multi-Index Confirmation Requirements for Sector Rotation

Sustainable sector rotation stock market moves require confirmation across Dow, Nasdaq, and S&P 500 indices rather than isolated strength in individual market segments. Steve's analysis demonstrates this principle through current conditions where Nasdaq shows projected strength while Dow indicates continued weakness, creating divergence that prevents systematic sector rotation positioning until broader alignment emerges.

Professional sector rotation analysis waits for Forecast and Visualizer charts to confirm the same directional bias across indices before committing capital to apparent sector leadership changes. This disciplined approach ensures that sector positioning aligns with institutional flow patterns rather than temporary technical factors or news-driven movements that lack structural support.

The confirmation process also involves recognizing when index divergence signals incomplete sector rotation that requires patience rather than aggressive positioning. Current market conditions exemplify this principle, with tech leadership insufficient to overcome broader market cycle projections pointing toward continued softness despite short-term resilience in technology sectors. Check our post on TQQQ Trading Strategy with Cycle Context: Smarter Entries, Better Outcomes for more info.

Risk Management During Incomplete Sector Rotation Periods

Managing risk during incomplete sector rotation requires systematic position sizing and timing criteria rather than full commitment to apparent sector leadership changes. Steve's emphasis on patience during periods when indices show divergent patterns demonstrates how professional traders avoid premature sector positioning that appears logical but lacks systematic confirmation through proper cycle alignment.

Risk management during sector rotation periods involves scaling position sizes based on confirmation quality rather than sector move magnitude, ensuring that capital commitment aligns with systematic validation levels rather than emotional reactions to apparent opportunities. This approach prevents overexposure to sectors showing strength without broader market confirmation and institutional flow support.

The systematic risk management approach also involves maintaining flexibility to adjust sector positioning as index alignment patterns evolve, recognizing that incomplete rotation can resolve in either direction depending on institutional flow developments and cycle timing confirmation across multiple market segments and economic catalysts. Check our post on Is Swing Trading Good for Beginners? Let Cycles and Crossovers Be Your Guide for more info.

People Also Ask About Sector Rotation Stock Market Alignment

How do you confirm sector rotation stock market moves before investing?

Confirming sector rotation stock market moves requires systematic analysis across multiple indices rather than isolated sector performance evaluation. Professional traders examine Dow, Nasdaq, and S&P 500 cycle patterns simultaneously to determine whether apparent sector leadership changes have institutional support through broader market confirmation signals.

The confirmation process involves waiting for Forecast and Visualizer charts to show aligned directional bias across indices, ensuring that sector moves reflect genuine institutional positioning rather than temporary news-driven strength. This systematic approach prevents premature positioning in sectors showing isolated strength without corresponding weakness in previous leaders and broader market validation.

Why do sector rotation stock market patterns fail without index alignment?

Sector rotation stock market patterns fail without index alignment because sustainable leadership changes require institutional flow confirmation across multiple market segments simultaneously. When indices show divergent patterns, apparent sector rotation often represents incomplete transitions that reverse quickly, leaving traders positioned in temporary strength without structural support.

Index alignment ensures that sector rotation reflects genuine institutional positioning changes rather than technical factors or isolated news catalysts that cannot sustain extended sector leadership transitions. Without this confirmation, sector moves typically prove temporary and unreliable for systematic positioning decisions that require sustained institutional flow patterns.

What role do treasury yields play in sector rotation stock market analysis?

Treasury yields influence sector rotation stock market dynamics by affecting different sectors differently based on interest rate sensitivity and borrowing cost structures. Rising yields typically pressure rate-sensitive sectors like utilities and REITs while potentially benefiting financial sectors through improved net interest margins, but these effects require cycle confirmation for systematic positioning.

Yield-driven sector rotation must be evaluated through systematic frameworks that determine whether interest rate pressures align with projected cycle timing and institutional flow patterns. Without this systematic analysis, yield changes often create temporary sector moves that lack the institutional confirmation necessary for sustained rotation patterns and reliable positioning opportunities.

How long do sector rotation stock market moves typically last?

Sector rotation stock market moves duration depends on institutional confirmation quality and cycle alignment rather than arbitrary time periods. Confirmed rotation supported by index alignment and cycle validation can persist for months or quarters, while incomplete rotation lacking systematic confirmation typically reverses within weeks or even days.

The systematic approach to sector rotation timing involves monitoring cycle projections and institutional flow patterns rather than assuming fixed rotation periods based on historical averages. Professional traders focus on confirmation quality and alignment maintenance rather than predetermined holding periods, adjusting positioning based on ongoing systematic validation rather than calendar-based expectations.

What are the most reliable sector rotation stock market indicators?

The most reliable sector rotation stock market indicators combine cycle analysis across multiple indices with institutional flow confirmation rather than single-sector performance metrics. Professional traders monitor Dow, Nasdaq, and S&P 500 cycle patterns simultaneously while tracking institutional positioning through volume analysis and cross-sector flow patterns.

Systematic sector rotation analysis relies on confirmation through multiple time-frames and index alignment rather than isolated technical indicators that may provide false signals. The most reliable approach combines cycle timing, institutional flow analysis, and economic catalyst evaluation through systematic frameworks that validate sector moves before positioning rather than reacting to apparent opportunities.

Resolution to the Problem

The challenge of timing sector rotation stock market moves gets resolved through systematic index alignment confirmation rather than isolated sector analysis that leads to premature positioning. By requiring confirmation across Dow, Nasdaq, and S&P 500 indices through cycle analysis, traders avoid the common mistake of chasing apparent sector strength without institutional validation.

This systematic approach eliminates the frustration of being positioned in sectors showing temporary strength that reverses quickly due to lack of broader market confirmation. Rather than guessing which sectors will outperform, the methodology focuses on waiting for institutional flow confirmation through index alignment that supports sustained sector leadership changes.

The resolution also addresses the psychological challenge of maintaining patience during periods when sectors appear to offer immediate opportunities but lack systematic confirmation. By requiring index alignment, traders develop discipline to avoid premature positioning that compromises systematic approaches to sector rotation analysis and capital allocation decisions.

Join Market Turning Points

Market Turning Points provides the systematic framework necessary for analyzing sector rotation stock market moves through proper index alignment and cycle confirmation rather than isolated sector analysis. Our approach combines multi-index cycle analysis with institutional flow tracking that creates clear criteria for sector rotation confirmation before positioning.

Members gain access to Forecast and Visualizer charts across Dow, Nasdaq, and S&P 500 indices that eliminate guesswork from sector rotation timing decisions. This systematic approach ensures that sector positioning follows proven methodologies based on index alignment and cycle confirmation rather than emotional reactions to apparent sector opportunities or news-driven sector moves.

The Market Turning Points community focuses on systematic sector rotation analysis that requires institutional confirmation rather than speculative positioning based on isolated sector strength. Join the Market Turning Points community to access the tools and analysis that support disciplined sector rotation strategies through proven index alignment methodologies.

Conclusion

Understanding why sector rotation stock market moves require index alignment for confirmation transforms speculative sector positioning into systematic opportunity assessment based on institutional flow validation. This disciplined approach ensures that sector rotation decisions reflect genuine leadership changes with structural support rather than temporary moves that reverse quickly.

The systematic methodology prevents the common mistake of chasing sector strength without broader market confirmation, recognizing that sustainable rotation requires institutional flow across multiple indices rather than isolated sector performance. This approach develops patience for proper confirmation while avoiding premature positioning in sectors lacking systematic validation.

Current market conditions exemplify the importance of index alignment, with tech showing strength through Nasdaq while industrials face pressure through Dow weakness, creating incomplete rotation that requires patience until broader confirmation emerges. The framework ensures that sector rotation strategies align with institutional reality rather than surface-level sector analysis that compromises systematic positioning decisions.

Author, Steve Swanson