Stock Market Predictions for May and June 2024: Understanding Intermediate Cycle Lows

- May 16, 2024

- 4 min read

Updated: Nov 19, 2025

Market Commentary/Forecast - May 16th, 2024

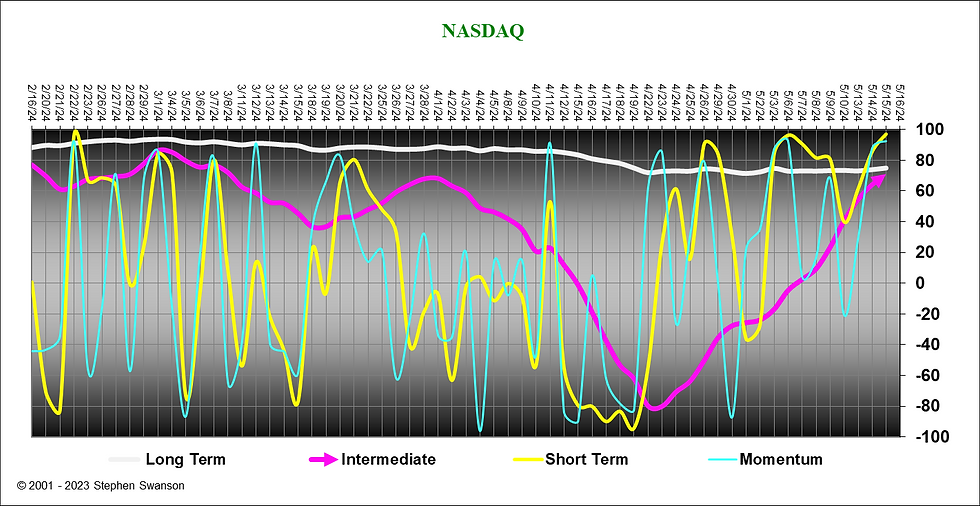

Intermediate cycle lows represent the best buying opportunities in the markets, both during bull and bear phases. In bear markets, intermediate rallies typically last 2-4 weeks, while rallies average a longer 4-6 weeks during bull markets. Even more favorable are situations when an intermediate low coincides with a long-term cycle low, as was the case last October. The subsequent advance can then average 4-6 months!

Analyzing Intermediate and Long-Term Cycle Lows

Understanding the behavior of intermediate and long-term cycle lows is crucial for making informed trading decisions. When an intermediate low aligns with a long-term cycle low, it creates a powerful buying opportunity, often resulting in a prolonged market advance. Last October, we witnessed such a scenario, which led to a robust six-month bull market.

However, this past six-month bull market advance was recently segmented in April by a 3-week decline ending on April 19th, followed by a new intermediate advance beginning on April 22nd. This current advance was not accompanied by a long-term cycle low and is therefore expected to fall within the typical 4-6-week rally range.

Current Market Conditions and Projections

We are currently four weeks into this advance, and according to projected cycles, a short-term pullback is expected on May 17th. This should be followed by sideways market action with another short-term peak on June 11th. Markets are then projected to have a more substantial intermediate decline lasting into the end of June.

This decline would be accelerated should the long-term cycle begin to decline by then, or become damped if the long-term cycle remained bullishly in the upper reversal zone on our forecast charts.

Strategic Trading Tips for May and June

Given the current market conditions and projections, here are some strategic tips to consider:

Adjust Stop-Loss Orders: As we approach the short-term pullback expected on May 17th, ensure that your stop-loss orders are set on long positions held since the early stages of this intermediate advance. This strategy helps protect your gains and manage risk during market fluctuations.

Monitor Key Market Dates: Pay close attention to the projected short-term peak on June 11th and the anticipated intermediate decline into the end of June. These key dates can significantly impact your trading strategy and decision-making.

Analyze Long-Term Cycles: Keep an eye on the long-term cycle behavior. If the long-term cycle begins to decline by the end of June, it could accelerate the market downturn. Conversely, if it remains bullish, the decline may be less severe.

Prepare for Market Volatility: Be prepared for potential market volatility, especially around the key dates mentioned. Having a robust trading plan can help you navigate these fluctuations and safeguard your investments.

Leveraging Market Turning Points for Accurate Predictions

Market Turning Points is designed to help traders predict market movements with high accuracy. By analyzing vast datasets and incorporating economic indicators, our platform offers timely, actionable insights that enable traders to make well-informed decisions.

Why Choose Market Turning Points?

Market Turning Points stands out by offering predictive accuracy up to 96%. This precision empowers individual traders to anticipate market turns and volatility, providing a significant edge in their trading strategies.

Understanding the Importance of Predictive Accuracy

One of the critical features of Market Turning Points is its exceptional predictive accuracy. By leveraging advanced algorithms and comprehensive data analysis, our platform can forecast market movements with a high degree of precision. This accuracy is particularly beneficial in volatile market conditions, where timely and accurate predictions can make a significant difference in trading outcomes.

Comprehensive Support and Educational Resources

Navigating the complexities of the stock market can be challenging. Market Turning Points addresses this by providing a robust educational program, including webinars, tutorials, and a wealth of resources. This support demystifies trading and equips users with the knowledge they need to succeed.

Detailed Webinars and Tutorials

Our webinars and tutorials cover a wide range of topics, from basic trading principles to advanced market analysis techniques. These educational resources are designed to cater to traders of all experience levels, ensuring that everyone can benefit from the insights provided. Topics include understanding market cycles, interpreting economic indicators, and developing effective trading strategies.

User Testimonials and Success Stories

Our users' success stories highlight the effectiveness of Market Turning Points. For instance, Greg K. from New York marvels at the system's ability to forecast market tops and bottoms accurately. Another trader noted the tool's accuracy in predicting a 52% market run in October, underscoring its transformative impact on trading strategies.

Ethical Trading Practices

At Market Turning Points, we are committed to ethical trading practices and transparency. We adhere to regulatory standards and promote a culture of responsibility within the trading community, ensuring that our users can trust the information and strategies provided.

Joining the Market Turning Points Community

Becoming a part of Market Turning Points means joining a community of traders committed to success. Our platform offers cutting-edge tools and fosters a collaborative environment for learning and growth.

Our Unique Guarantee

We believe in the power of Market Turning Points to revolutionize your trading strategy. That's why we offer a unique guarantee: if our tool does not help you achieve your trading goals within the first month, we will work with you to optimize your use of the platform. If you are still not satisfied, we offer a full refund, no questions asked. This ensures that you can try Market Turning Points risk-free and experience its benefits firsthand.

Conclusion

As we approach the anticipated short-term pullback on May 17th and look ahead to the projected market movements in June, staying informed and planning your trades carefully is crucial. Using the insights and tools provided by Market Turning Points, you can protect your investments and capitalize on market opportunities. Visit Market Turning Points to learn more and transform your trading strategy today.

Author, Steve Swanson