Expansion Markets When Capital Rotates Into Hard Assets and Cyclicals

- 1 day ago

- 6 min read

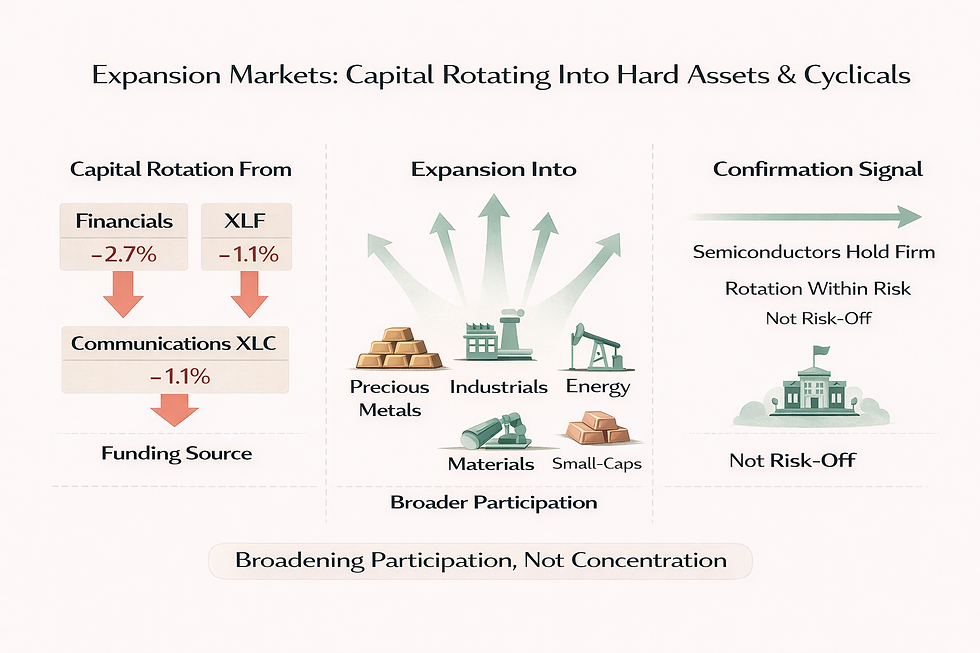

This week in trading has been about rotation. Money is moving into real assets and cyclicals, not piling into the same mega-cap growth trade. Precious metals led the tape this week. Silver continued its surge, with SLV and SIVR up nearly 20%, and the leveraged silver fund AGQ jumping more than 40%. That isn't panic buying. It's capital deliberately rotating into hard assets.

Beneath the surface, the shift was even clearer. Industrials, materials, energy, and housing all outperformed. XLI, XLB, XME, XLE, ITB, XHB, URA showed strength across the board. Capital is moving toward hard assets, manufacturing, housing, and cyclicals, and away from crowded growth trades. When participation broadens like this, it typically marks a healthier phase of a bull market, even if price action still appears choppy.

Capital is broadening, not retreating. That supports the larger bullish structure even as leadership shifts. This is not a chase-the-breakout environment, but is a buy-the-dip and rotate-with-the-trend environment. When rotation is healthy, opportunity keeps coming. Right now, that points to a rising short-term move into a Jan. 21-30 peak.

What Expansion Markets Look Like

Expansion markets occur when capital broadens beyond narrow leadership into sectors and capitalizations that previously lagged. This week demonstrated that pattern through precious metals, industrials, materials, energy, housing, and smaller capitalizations all outperforming while financials provided funding. That's deliberate rotation creating wider participation, not panic or speculation.

Small and mid-caps echoed the theme with IWM, IJR, and MDY outpacing broader indices while TNA ripped higher. Classic risk-on behavior, but controlled. This is rotation out of over-owned leadership into areas that lagged, understanding dynamics detailed in How to Swing Trade Using Cycle Timing and Price Structure Not Emotion.

Where Capital Rotation Comes From

Capital rotation comes from sectors that became crowded or over-owned flowing into areas showing relative value or technical improvement creating the expansion dynamic. So where is the money coming from this week? Primarily financials and crowded growth. XLF fell roughly 2.7% for the week, making it one of the weakest major sector ETFs. Banks and diversified financials were clear sources of funds as capital rotated out.

Communication services lagged as well, with XLC down about 1.1%, reflecting cooling momentum in media and platform-heavy names that already ran hard. This rotation from financials and communications into hard assets, industrials, and small-caps creates the expansion. Capital isn't exiting markets. It's redistributing from concentrated positions into broader participation, applying principles detailed in Margin Debt Record $1.18 Trillion Marks Elevated Risk Before Fed Decision.

Why Semiconductors Holding Signals Rotation Within Risk

Semiconductors holding signals rotation within risk because chips represent cyclical growth exposure that would weaken if capital were fleeing markets. This week semiconductors held firm with SOXX up about 5.5% and SOXL up roughly 17%. When chips stay strong while financials weaken, it signals rotation within risk, not an exit from it.

This distinction matters for positioning. The pattern confirms capital is broadening, not retreating, supporting the larger bullish structure through leadership shifts rather than breakdown, understanding frameworks detailed in Swing Trading ETFs With Cycle Timing: How to Avoid Late Entries Near Market Tops.

How To Position During Market Expansion

Positioning during market expansion focuses on buying pullbacks in emerging leadership while avoiding chasing breakouts in areas showing late-cycle exhaustion. This is not a chase-the-breakout environment. It is a buy-the-dip and rotate-with-the-trend environment. When participation broadens like this, it typically marks a healthier phase of a bull market. Capital expanding into lagging sectors creates opportunities in those areas while previous leaders consolidate gains.

The tactical approach requires discipline around stops and position sizing. All long positions should be protected by stops under the 2/3, 3/5, and even the 4/7 crossover levels. Stay sized appropriately with no more than 2% risk per position. Let the underlying bullish trend work and stay patient. When rotation is healthy, opportunity keeps coming. Right now, that points to a rising short-term move into a Jan. 21-30 peak as expansion continues supporting the advance through broader participation rather than concentration.

People Also Ask About Expansion Markets

What are expansion markets?

Expansion markets occur when capital broadens beyond narrow leadership into sectors and capitalizations that previously lagged, creating wider participation that supports sustainable advances. Instead of gains concentrating in a few names, strength spreads across industrials, materials, energy, housing, small-caps, and mid-caps. This broadening typically marks healthier phases where advances become more sustainable through distributed participation rather than dependence on concentrated leadership.

How do you identify market expansion?

Identifying market expansion requires monitoring sector performance breadth and market capitalization participation beyond price indices. When small-caps, mid-caps, and cyclical sectors outperform simultaneously while previous leaders consolidate, it signals expansion. The money flow matters as much as performance. When rotation occurs within risk rather than into defensive sectors, it confirms expansion through broadening participation rather than flight to safety.

Why does capital rotate into hard assets?

Capital rotates into hard assets when investors seek inflation protection, value opportunities, or diversification away from crowded growth trades. Hard assets include precious metals, industrials, materials, energy, and housing that provide tangible value and inflation hedge characteristics. The rotation often occurs after growth trades concentrate gains creating valuation concerns or technical exhaustion, making previously lagging hard assets attractive on relative value and technical improvement.

What is rotation within risk?

Rotation within risk occurs when capital moves between growth and cyclical sectors while maintaining market exposure rather than fleeing into defensive positions. Risk-off shows defensive sectors strengthening while both growth and cyclicals weaken together. Rotation within risk shows some areas consolidating while others strengthen with overall exposure maintained. When cyclical growth areas like semiconductors hold firm while other sectors redistribute capital, it confirms rotation within risk where capital redistributes across sectors rather than exiting markets.

How should you trade expansion markets?

Trading expansion markets requires buying pullbacks in emerging leadership while avoiding chasing exhausted areas, maintaining discipline around stops and position sizing. This is buy-the-dip and rotate-with-the-trend environment where opportunities develop in sectors showing relative strength as previous leaders consolidate. Position sizing stays at 2% maximum risk with stops under crossover levels. When rotation is healthy through expansion, opportunity keeps coming as different sectors take leadership rather than concentration in narrow areas creating vulnerability.

Resolution

Expansion markets when capital rotates into hard assets and cyclicals create multiple entry opportunities across sectors rather than dependence on narrow leadership. The pattern supports tactical positioning through buying pullbacks in emerging areas while previous leaders consolidate. This broadening validates continuation through distributed risk rather than concentration vulnerability.

Semiconductors holding firm while financials weaken confirms rotation within risk. The invalidation condition would be semiconductors AND small-caps both weakening together with financials, signaling actual risk-off. Current setup shows chips firm and small-caps strong, confirming the rotation pattern remains intact.

The Jan. 21-30 timing window matters because rotation phases typically persist 2-3 weeks before consolidation. Position through buying pullbacks with stops under crossover levels at 2% maximum risk. This is buy-the-dip and rotate-with-the-trend environment where healthy rotation creates ongoing opportunities as different sectors assume leadership.

Join Market Turning Point

Most traders miss expansion opportunities by either chasing exhausted leadership or ignoring emerging sectors. The chase approach enters late into areas completing runs. The ignore approach holds consolidating positions without recognizing capital shifting into areas showing relative strength.

Understanding expansion markets through sector rotation separates sustainable advances from vulnerable concentration. The current rotation shows controlled characteristics, not euphoric. Volume and momentum patterns demonstrate measured capital flow rather than blow-off speculation. When participation broadens while semiconductors hold firm, it signals healthy rotation within risk creating distributed leadership rather than defensive flight or late-cycle excess.

Access systematic approaches to expansion markets at Market Turning Point through sector analysis and cycle positioning. Master identifying market expansion through breadth indicators and performance patterns. See how rotation within risk differs from risk-off. Learn positioning during expansion through buying pullbacks in emerging leadership while maintaining disciplined stops and sizing.

Conclusion

Expansion markets through capital rotation into hard assets and cyclicals create tactical opportunities across multiple sectors. Materials and energy leading while tech holds represents early-to-mid cycle behavior supporting the expansion thesis through cyclical strength. The pattern favors distributed positioning rather than concentrated exposure as leadership broadens.

Semiconductors holding firm validates rotation within risk. Crossover level stops serve as rotation insurance, protecting if the pattern reverses while letting you participate in the expansion. Position sizing at 2% maximum maintains discipline as opportunities develop across emerging sectors.

The environment points to rising short-term move into Jan. 21-30 peak. Buy pullbacks in sectors showing relative strength. Let rotation work through patience rather than chasing. When participation broadens, different areas assume leadership creating ongoing opportunities. The advance continues through distributed capital rather than narrow concentration, making selective positioning across multiple sectors the tactical approach.

Author, Steve Swanson