The Truth About Bitcoin Inverse ETF 3x in the New Institutional Era

- Aug 8, 2025

- 10 min read

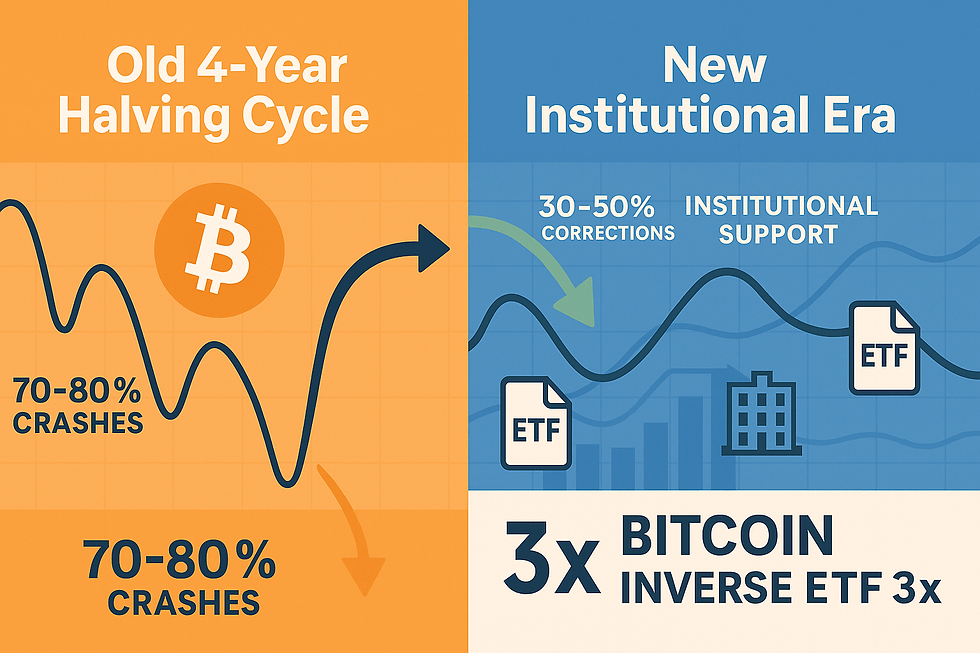

Bitcoin's transformation from a speculative retail playground to an institutional asset class has fundamentally changed how traders should approach inverse strategies. The old playbook of betting against 70-80% crashes during "crypto winters" no longer works when BlackRock and other institutional giants are providing structural support at every meaningful dip.

This shift creates both opportunities and traps for those considering Bitcoin inverse ETF 3x positions. Understanding the new cycle dynamics isn't just helpful - it's essential for survival. The mechanical four-year halving cycle that previously drove predictable boom-bust patterns has been replaced by institutional flow cycles that follow entirely different rhythms and magnitudes.

At Market Turning Points, we've observed that successful inverse strategies now require understanding institutional behavior rather than just technical patterns or halving schedules. This article will show you why traditional crypto cycle analysis fails in the institutional era, how Bitcoin inverse ETF 3x products perform under the new dynamics, and most importantly, when these leveraged short instruments make sense versus when they become value destroyers.

Bitcoin's Cycle Shift and What It Means for Inverse Strategies

Cycles aren't random. In every market - stocks, bonds, commodities - price action repeats because institutional money moves in waves. They buy and sell based on macro trends, policy shifts, and liquidity - not on gut feel. Those waves create the patterns we can trade.

For most of its life, Bitcoin's cycles had nothing to do with that. Its cycle was built into the code: the four-year halving. Cut the supply, spark a rally, hit a peak, then crash 70-80% into a long "crypto winter." It was about as close to a mechanical pattern as you could get.

But as CNBC recently pointed out, that rhythm is breaking down. The launch of spot Bitcoin ETFs in early 2024 pulled billions in before the April halving - $14.8 billion by mid-July, with BlackRock's IBIT taking in $1.3B in just two days.

Institutions started to front-run the move, and Bitcoin hit a record high in July instead of the typical year-after-halving surge. That's a cyclical response you only get when deep-pocket players are steering its behavior.

This fundamental shift changes everything about Bitcoin inverse ETF 3x timing. The traditional strategy of waiting for post-halving peaks and riding the inevitable 70% collapse no longer works when institutional buyers treat major dips as accumulation opportunities rather than panic selling events. Check our post on Master the 4 Stages of Stock Cycle to Avoid False Market Bottoms for more info.

How Institutional Flows Change Inverse ETF Performance

Institutional flows don't behave like retail. They scale in, hedge, and hold. That's why we're not seeing the brutal 70-80% collapses of the past. Instead, 30-50% pullbacks are more likely - still sharp, but shorter-lived and more controlled. And the drivers are changing. It's not just the halving anymore. Liquidity, macro conditions, regulation, and risk appetite are the new levers.

This creates a challenging environment for Bitcoin inverse ETF 3x products. These instruments are designed to amplify moves through daily rebalancing, but they perform poorly during sideways consolidation periods. When Bitcoin experiences controlled 30-50% corrections instead of brutal 70-80% crashes, the time decay and volatility drag of 3x inverse products can destroy returns even when the directional bet proves correct.

The mathematical reality of leveraged inverse ETFs becomes particularly punishing when institutional support creates frequent whipsaws. A 10% Bitcoin rally followed by a 10% decline doesn't result in flat performance for a 3x inverse product - it results in losses due to the compounding effect of daily rebalancing during volatile periods.

Moreover, institutional flows tend to create more predictable support levels based on technical analysis and portfolio allocation models. This means Bitcoin inverse ETF 3x positions face the constant risk of institutional buying at predetermined levels, limiting the duration and magnitude of declines that inverse strategies depend on for profitability.

The New Reality: Shorter, Shallower Corrections

The rest of the crypto market will feel it - but not equally. Large caps like Ethereum and Solana will track Bitcoin's new rhythm more closely because they have deeper liquidity and real infrastructure. But they're still riding shotgun.

Institutions don't diversify evenly across altcoins - they have been rotating selectively, chasing specific narratives while Bitcoin becomes more stable and consolidating. Smaller coins will still swing wildly because they're driven by speculative retail, not structured institutional inflows.

For Bitcoin inverse ETF 3x traders, this means the opportunity set has fundamentally changed. The multi-month decline phases that previously made inverse strategies profitable have been replaced by shorter, more controlled corrections that often reverse before leveraged inverse products can generate meaningful returns.

The velocity of institutional buying during dips also means that inverse positions must be timed much more precisely. The days of accumulating inverse exposure during obvious bubble phases and holding for months during the inevitable collapse are largely over. Instead, inverse strategies now require tactical timing around shorter-term cycle peaks and immediate exit discipline when institutional support emerges. Check our post on QQQ vs SPY Performance: Why Narrow Leadership Still Drives Broad Opportunity for more info.

Regulation as a Structural Support Factor

Regulation is also shifting from being a headwind to a tailwind. Retirement plans can now hold crypto, public companies are adding Bitcoin to reserves, and Washington is actually engaging by creating policy instead of fighting it. That removes some of the panic-selling risk that fueled past winters.

This regulatory evolution creates structural headwinds for Bitcoin inverse ETF 3x strategies. When regulatory clarity reduces tail risks and enables broader institutional adoption, it eliminates many of the fear-driven selloffs that inverse products depend on. The existential concerns that previously drove 70-80% corrections are being systematically removed from the equation.

Furthermore, regulatory approval of spot Bitcoin ETFs has created new demand sources that didn't exist during previous cycles. 401(k) allocations, pension fund exposure, and corporate treasury adoption all represent "sticky" institutional demand that doesn't panic sell during market stress. This creates a higher floor for Bitcoin prices and reduces the magnitude of corrections that inverse strategies can exploit.

The result is a structural bias toward shorter correction periods and shallower decline magnitudes - exactly the conditions that make leveraged inverse products most challenging to trade profitably.

Why Traditional Crypto Cycle Analysis Fails Now

This is why our Visualizer matters - it cuts through the noise. The halving may be losing its punch, but cycles aren't going away. They're becoming more stable and aligning with institutional behavior, which makes them easier to track over time.

Traditional crypto cycle analysis focused on halving schedules, retail sentiment extremes, and technical chart patterns. These approaches fail in the institutional era because they don't account for the systematic buying that occurs during traditional "oversold" conditions.

Institutional traders don't panic sell during market stress - they often increase allocations when prices fall below their models' fair value estimates. This creates a fundamental mismatch between traditional cycle analysis and current market structure. What previously looked like obvious short opportunities now become value traps for inverse strategies.

Successful Bitcoin inverse ETF 3x timing now requires understanding the same factors that drive other institutional asset classes: Federal Reserve policy, macro liquidity conditions, correlation dynamics with traditional markets, and institutional flow patterns. The crypto-specific analysis that worked during the retail-dominated era provides false signals in the current environment.

Current Market Applications for Inverse Strategies

Bottom line: Bitcoin is maturing into an institutional asset. The cycles are there, but they're evolving from mechanically driven to macro-driven. Altcoins will benefit too - but with more volatility and less predictability. In this environment, watching the halving date isn't enough. You need to track the same cyclical forces that move every major market: liquidity, rates, and the timing of big money flows.

Given these structural changes, Bitcoin inverse ETF 3x products now work best as tactical hedging instruments rather than strategic directional bets. The most effective applications involve short-term positions around obvious cycle peaks when institutional flows are showing signs of exhaustion rather than trying to capture multi-month decline phases.

The key is understanding that institutional Bitcoin cycles follow quarterly rebalancing schedules, Federal Reserve policy cycles, and broader risk asset correlation patterns. When these factors align for short-term weakness, inverse products can still generate returns. But the holding periods are measured in weeks, not months, and the exit discipline must be immediate when institutional support emerges.

Position sizing becomes crucial given the shortened time horizons and reduced magnitude of corrections. Bitcoin inverse ETF 3x positions should represent small tactical allocations rather than core portfolio positions, acknowledging that the structural tailwinds for Bitcoin now outweigh the cyclical headwinds that inverse strategies depend on. Check our post on Short Squeeze Pattern: Trade the Spike Only When Cycles and Crossovers Align for more info.

People Also Ask About Bitcoin Inverse ETF 3x

What is a Bitcoin inverse ETF 3x and how does it work?

A Bitcoin inverse ETF 3x is a leveraged exchange-traded fund designed to provide three times the inverse daily performance of Bitcoin. When Bitcoin falls 1%, the inverse ETF aims to rise 3%, and vice versa. These products use derivatives, swaps, and other financial instruments to achieve this leveraged exposure, rebalancing daily to maintain the 3x target ratio.

The daily rebalancing mechanism is crucial to understand because it creates compounding effects that can significantly impact long-term performance. During volatile periods with frequent directional changes, the mathematical effects of daily rebalancing can cause substantial losses even when the underlying directional bet proves correct over time. This makes these products most suitable for short-term tactical trades rather than long-term strategic positions.

How has institutional adoption changed Bitcoin inverse ETF performance?

Institutional adoption has fundamentally altered the risk-reward profile of Bitcoin inverse ETF 3x products by reducing the frequency and magnitude of the severe corrections these instruments depend on for profitability. Previously, Bitcoin experienced 70-80% crashes during "crypto winters" that could generate substantial returns for inverse strategies over multi-month periods.

With institutional support providing systematic buying during significant dips, Bitcoin corrections are now typically limited to 30-50% declines that reverse more quickly. This creates a challenging environment for leveraged inverse products, which suffer from time decay and volatility drag during the shorter correction periods. The structural support from ETF flows, corporate treasuries, and institutional allocations has essentially eliminated the existential selling that previously drove the most profitable opportunities for inverse strategies.

When should you consider using Bitcoin inverse ETF 3x products?

Bitcoin inverse ETF 3x products are now most appropriate for short-term tactical hedging around obvious cycle peaks when institutional flows show signs of exhaustion, rather than as long-term directional bets against Bitcoin. The optimal timing typically coincides with Federal Reserve policy shifts, liquidity tightening, or broader risk asset correlation breakdowns that affect institutional demand.

The key is recognizing that these instruments now require precise entry and exit timing with holding periods measured in weeks rather than months. They work best when multiple factors align: technical resistance levels, institutional flow data showing reduced accumulation, and macro conditions that reduce systematic buying interest. Position sizing should remain small given the shortened opportunity windows and reduced correction magnitudes in the institutional era.

What are the risks of holding Bitcoin inverse ETF 3x long-term?

The primary risk of holding Bitcoin inverse ETF 3x products long-term is the mathematical deterioration that occurs through daily rebalancing during volatile periods, even when the underlying directional bias proves correct. These products are designed for short-term tactical use, and extended holding periods almost invariably result in performance that significantly lags the inverse of Bitcoin's actual price movement.

In the current institutional era, additional risks include the structural tailwinds supporting Bitcoin prices through systematic institutional buying, regulatory clarity reducing tail risks, and the correlation with traditional risk assets during market stress periods. The combination of mathematical decay and structural support for Bitcoin prices creates a challenging environment where even correct timing can result in losses if positions are held too long or sized too aggressively.

How do Bitcoin inverse ETF 3x products compare to shorting Bitcoin directly?

Bitcoin inverse ETF 3x products offer easier access and eliminate the complexity of margin requirements, borrowing costs, and custody issues associated with shorting Bitcoin directly. However, they introduce different risks including daily rebalancing effects, management fees, and tracking errors that don't exist with direct shorting strategies.

The leveraged nature of 3x products means they can generate larger returns than direct shorting during favorable periods, but they also create amplified losses and faster deterioration during adverse conditions. In the institutional era where Bitcoin corrections tend to be shorter and shallower, the daily rebalancing effects of ETF products often make direct shorting strategies more effective for traders who can access them, despite the additional complexity and cost considerations.

Resolution to the Problem

The fundamental problem with Bitcoin inverse ETF 3x strategies in the institutional era is applying retail-era tactics to an institutionally-driven market. Traders continue using halving-based cycle analysis and expecting 70-80% corrections that institutional support now prevents from occurring with the same frequency or magnitude.

The solution requires understanding that Bitcoin cycles now follow institutional flow patterns rather than mechanical halving schedules. This means timing inverse strategies around Federal Reserve policy, macro liquidity conditions, and institutional rebalancing cycles rather than crypto-specific technical analysis. The opportunity windows are shorter, requiring tactical rather than strategic approaches.

Stop expecting the brutal crypto winters of the past and start treating Bitcoin inverse ETF 3x products as short-term hedging instruments around institutional cycle peaks. Use proper position sizing, maintain strict exit discipline, and focus on the macro factors that drive institutional demand rather than traditional crypto cycle indicators.

Join Market Turning Points

Ready to stop getting trapped by outdated crypto cycle analysis and start understanding how institutional flows affect Bitcoin inverse strategies? Market Turning Points teaches you exactly how to adapt traditional cycle analysis to the new institutional era and time inverse positions around institutional flow patterns.

You'll learn to identify when institutional support is waning, how to use macro cycle analysis for Bitcoin timing, and most importantly, how to size and manage Bitcoin inverse ETF 3x positions in an environment where traditional correction patterns no longer apply. No more holding inverse positions through institutional buying waves.

Master institutional-era Bitcoin cycle analysis with Market Turning Points. Get access to real-time institutional flow analysis, Bitcoin cycle timing updates, and learn why understanding macro factors now matters more than halving schedules for inverse strategies.

Conclusion

Bitcoin inverse ETF 3x products face a fundamentally different landscape in the institutional era. The mechanical four-year halving cycles that previously created predictable opportunities for inverse strategies have been replaced by institutional flow cycles that provide structural support during traditional correction periods.

This doesn't eliminate opportunities for inverse strategies, but it requires a complete rethinking of timing, duration, and position sizing. The successful approach now focuses on short-term tactical positions around institutional cycle peaks rather than long-term strategic bets against crypto's structural growth.

The next time you consider a Bitcoin inverse ETF 3x position, ask whether institutional flows support the trade or whether you're fighting against systematic buying from ETFs, corporate treasuries, and institutional allocators. In most cases, the structural tailwinds now outweigh the cyclical headwinds, making precise timing and quick exits essential for any inverse strategy success.

Author, Steve Swanson