Moving Average Crossover Strategy: The Truth About Confirmation vs. Prediction

- Aug 4, 2025

- 10 min read

Most traders use moving average crossover strategy to predict where markets will go next. They see a golden cross or death cross and assume it's a crystal ball telling them what's about to happen. But here's the uncomfortable truth: crossovers don't predict anything. They confirm what's already happening.

This misunderstanding destroys more trading accounts than market crashes ever could. Traders enter positions based on moving average signals alone, only to get whipsawed when the signal proves false. They treat confirmation as prediction, then wonder why their entries fail so consistently.

At Market Turning Points, we've learned that moving average crossover strategy only works when it's the final piece of a larger puzzle. The crossover isn't your entry signal - it's your confirmation that everything else is aligned. This article will show you why most crossover strategies fail, how to use crossovers as filters instead of predictors, and most importantly, why the 3-T's method turns moving averages from misleading indicators into powerful confirmation tools.

Why Moving Average Predictions Fail and When They Actually Work

The biggest lie in trading is that moving average crossovers predict future price movement. Walk into any trading forum and you'll see charts covered in golden crosses with bold predictions about the rally that's coming. These traders have it backwards. They're trying to use a lagging indicator to forecast the future.

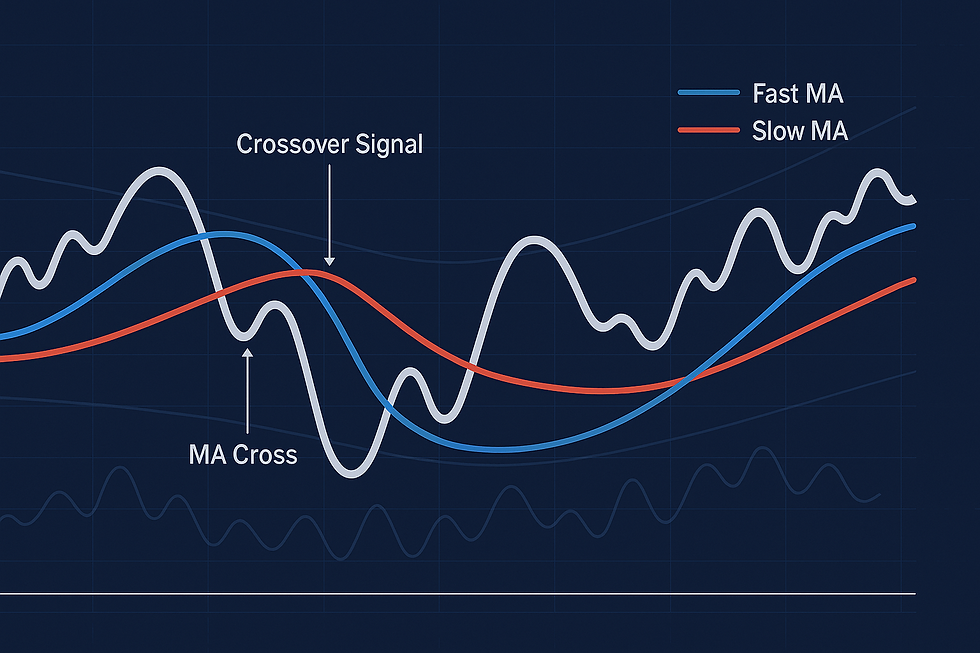

Moving averages are mathematical constructs based on past prices. When a fast average crosses above a slow one, it's telling you what already happened, not what's about to happen. The crossover confirms that buying pressure has been building - but it says nothing about whether that pressure will continue tomorrow, next week, or next month.

This fundamental misunderstanding leads to the classic moving average trap. Traders see a bullish crossover and assume it's the start of a new uptrend. They buy aggressively, only to watch prices reverse as soon as they enter. The crossover was real, but it marked the end of the move, not the beginning. Smart money had already positioned for the rally and was selling into the crossover enthusiasm.

Successful moving average crossover strategy requires context, not just signals. That context comes from what we call the 3-T's: Trend, Timing, and Technicals. Each T provides a different piece of the puzzle, and only when all three align do crossovers become reliable. The first T is Trend - the dominant direction of longer-term cycles. The second T is Timing - knowing when cycle turns are due. The third T is Technicals - price behavior that confirms the signal is real.

How Crossovers Filter Noise and Reading Different Combinations

The real power of moving average crossover strategy isn't in prediction - it's in filtration. Markets are constantly moving up and down with random noise, false breakouts, and emotional reactions. Crossovers help you separate meaningful moves from meaningless chop, but only when used correctly.

Think of crossovers as your final checkpoint before committing capital. Cycles might be turning up, trends might be aligned, and timing might be perfect - but if price can't stay above the crossover level, something's wrong. The market is telling you that despite all the favorable conditions, buyers aren't stepping in with conviction.

This filtering process keeps you out of trades that look good on paper but fail in reality. How many times have you seen perfect setups that immediately fail after entry? Often, those failures could have been avoided by waiting for crossover confirmation. The moving average crossover strategy doesn't cause the win - it confirms that the conditions for winning are actually present.

Not all moving average crossovers are created equal. The combination you choose determines how sensitive your signals are and how much noise you'll encounter. Fast combinations like 3/5 exponential averages catch turns quickly but generate more false signals. Slower combinations like 10/20 simple averages reduce noise but lag significantly behind price action. The key insight is matching your crossover speed to your trading timeframe and risk tolerance. Check our post on Stock Market Cycles Explained: How to Predict and Profit for more info.

Why Single Crossover Signals Are Trading Suicide

Here's where most moving average crossover strategies die: traders treat individual crossover signals as complete trading systems. They see a golden cross and buy. They see a death cross and sell. This mechanical approach ignores everything else happening in the market and leads to consistent losses.

Single crossover signals fail because they operate in a vacuum. They don't consider whether the broader trend supports the signal, whether timing aligns with cycle projections, or whether price action confirms the crossover is real. They're taking one piece of information and betting their account on it.

The current market perfectly illustrates why single signals fail. Recent days have shown various crossover signals on different timeframes, but the intermediate cycle is still rolling over. Traders who bought solely based on bullish crossovers without considering the broader context found themselves fighting against the dominant trend. The crossovers were real, but they marked counter-trend bounces within a larger decline.

Instead of trading crossovers in isolation, use them as part of a comprehensive system. Wait for trend alignment, cycle timing, and price confirmation before acting on any crossover signal. This integrated approach transforms moving averages from unreliable predictors into valuable confirmation tools that actually improve your trading results.

The Current Market Through the 3-T's Lens

Right now, the market provides a perfect case study in why moving average crossover strategy requires the full 3-T's framework. Looking at current conditions through each lens reveals why simple crossover signals would be misleading.

From a Trend perspective, we have mixed signals. The long-term white line remains bullish, providing macro support for any rallies. However, the intermediate magenta line has clearly started rolling over into an expected 2-week decline. This creates a challenging environment where bullish crossovers might work for short-term bounces but are unlikely to generate sustained moves higher.

The Timing element shows short-term cycles approaching the lower reversal zone where bounces typically occur. This suggests any bullish crossovers in the coming days should be taken more seriously than those happening randomly. The cycles are providing the context that makes crossover signals meaningful rather than noise.

Technically, crossover averages are currently in decline across multiple timeframes. Any bullish crossovers would need to be accompanied by strong closes above the averages and sustained buying pressure to be considered valid. The technical picture is telling us to be skeptical of crossover signals until price action proves they're real.

This analysis shows why mechanical crossover trading fails while integrated analysis succeeds. The same bullish crossover signal could be meaningless noise or a significant opportunity depending on how it aligns with trend, timing, and technical confirmation. Check our post on QQQ Strategy That Works: Trade the Decline with Crossovers, Price Channels and Cycle Timing for more info.

Common Moving Average Crossover Mistakes

Even traders who understand crossovers need confirmation often make critical mistakes in execution. The most common error is jumping on crossovers without waiting for price confirmation. They see the moving averages cross and immediately enter positions, ignoring whether price can actually sustain levels above the crossover point.

Another frequent mistake is using the wrong combination for their trading style. Aggressive traders use slow crossovers and miss opportunities waiting for signals. Conservative traders use fast crossovers and get whipsawed by noise. The crossover speed must match your risk tolerance and time horizon.

The third major error is ignoring the broader market context. Traders get tunnel vision on their crossover signals while ignoring cycle analysis, trend direction, and volume patterns. They treat the moving average crossover strategy as a complete system rather than one component of a larger framework.

Perhaps the biggest mistake is treating all crossovers equally. A bullish crossover during a strong uptrend with good volume is very different from one during a downtrend with weak participation. Context determines meaning, but most traders ignore context in favor of mechanical signal following.

Building a Complete Crossover System

A proper moving average crossover strategy integrates multiple elements rather than relying on signals alone. Start with cycle analysis to understand the dominant trends and timing. This provides the foundation for interpreting any crossover signals you encounter.

Next, establish your crossover combinations based on your trading timeframe. Short-term traders might monitor 3/5 exponential crossovers for quick entries while also watching 10/20 simple crossovers for broader context. The faster signals provide timing while slower ones confirm direction.

Most importantly, develop confirmation criteria that must be met before acting on any crossover signal. This might include closes above the crossover level, volume expansion, or alignment with cycle projections. The crossover gets your attention, but confirmation gets your money.

Risk management remains crucial regardless of how good your crossover system becomes. Use stops below recent support levels or the slower moving average. Size positions appropriately for the timeframe you're trading. Remember that even the best crossover systems will generate losing trades - your job is to keep them small while letting winners run. Check our post on Bitcoin ETF with Dividends: How Market Cycles Impact High-Yield Crypto ETFs for more info.

People Also Ask About Moving Average Crossover Strategy

What is the most effective moving average crossover strategy?

The most effective moving average crossover strategy combines multiple timeframes and requires confirmation from trend, timing, and technical analysis. Rather than relying on a single crossover signal, successful strategies use fast combinations like 3/5 for entry timing while monitoring slower combinations like 10/20 for trend confirmation. The key is matching crossover speed to your trading timeframe and always waiting for price confirmation above the crossover level before entering positions.

The effectiveness comes from treating crossovers as filters rather than standalone signals. Professional traders never act on crossover signals alone - they wait for alignment with cycle analysis, volume confirmation, and price action that supports the signal. This integrated approach transforms moving averages from unreliable predictors into valuable confirmation tools that significantly improve win rates and reduce false signals.

How do you avoid false signals in moving average crossovers?

Avoiding false signals requires treating crossovers as confirmation rather than prediction. Never trade a crossover in isolation - wait for alignment with cycle timing, trend direction, and volume confirmation. Use multiple timeframes to filter signals, focusing on crossovers that align across different time horizons. Most importantly, require price to sustain levels above bullish crossovers with strong closes and follow-through buying before committing capital.

The most effective filter is the 3-T's framework: ensuring Trend alignment with longer-term cycles, proper Timing based on cycle projections, and Technical confirmation through price action. False signals typically occur when traders ignore one or more of these elements. By waiting for complete alignment, you eliminate most whipsaws while positioning for high-probability setups that have multiple confirming factors working in your favor.

What time frame works best for moving average crossover trading?

The best timeframe depends on your trading style and risk tolerance. Day traders often use 5-minute charts with fast crossovers like 3/5 exponential averages. Swing traders typically focus on hourly or 4-hour charts with moderate combinations like 4/7. Position traders prefer daily charts with slower crossovers like 10/20 or 20/50. The key is consistency - stick to timeframes that match your trading schedule and risk management approach.

However, successful crossover trading requires monitoring multiple timeframes regardless of your primary focus. Even day traders should check daily and weekly charts to understand the broader trend context. Similarly, position traders benefit from shorter timeframes to fine-tune entries and exits. The crossover signals on your primary timeframe provide timing, while longer timeframes confirm trend direction and shorter ones help with precise execution.

Should you use simple or exponential moving averages for crossovers?

Exponential moving averages react faster to price changes, making them better for short-term trading and quick confirmations. Simple moving averages provide smoother signals with less noise, making them preferable for longer-term analysis. Many successful traders use exponential averages for fast signals and simple averages for slower confirmation. The choice depends on whether you prioritize responsiveness or smoothness in your crossover strategy.

The optimal approach often combines both types within a comprehensive system. Use exponential averages like 3/5 EMA for entry timing and simple averages like 10/20 SMA for trend confirmation. This dual approach captures the benefits of both: quick reaction times for entries while maintaining smooth trend identification. The key is understanding what each type measures and using them appropriately within your overall strategy framework.

How do you set stop losses with moving average crossover trades?

Stop losses in crossover trades should be placed below the slower moving average or recent support levels that held during the setup. For bullish crossovers, initial stops typically go below the crossover point or the previous swing low. As trades move favorably, trail stops using the rising moving averages as dynamic support. The goal is protecting against crossover failures while giving successful trades room to develop.

The stop placement strategy should align with your crossover timeframe and combination speed. Fast crossovers require tighter stops since they generate more frequent signals, while slower crossovers can use wider stops that account for normal volatility. Advanced traders often use multiple stop levels: a close stop for quick protection against immediate failures and a wider stop for the overall position. This layered approach maximizes protection while allowing for normal market movement around the crossover levels.

Resolution to the Problem

The fundamental problem with most moving average crossover strategies is treating confirmation signals as prediction tools. Traders see crossovers and assume they know what happens next, leading to poor entries and consistent losses. The solution is understanding that crossovers confirm what's already happening, not what's about to happen.

This realization transforms how you use moving averages. Instead of jumping on every crossover signal, you wait for the 3-T's alignment: favorable trend direction, proper cycle timing, and technical confirmation. The crossover becomes your final checkpoint, not your entry trigger.

Stop hunting for the perfect crossover combination and start building a complete system. Use cycles to understand timing, trends to determine direction, and crossovers to confirm that conditions are actually present. This integrated approach turns moving averages from unreliable predictors into valuable filters that improve your trading results.

Join Market Turning Points

Ready to stop getting whipsawed by false crossover signals and start using moving averages the right way? Market Turning Points teaches you exactly how to integrate crossover analysis with cycle timing and trend confirmation. Our systematic approach removes the guesswork from moving average trading.

You'll learn to read our proprietary crossover combinations, understand when signals are meaningful versus noise, and most importantly, how to wait for complete 3-T's alignment before risking capital. No more mechanical signal following that leads to consistent losses.

Master the 3-T's approach to moving average crossover strategy with Market Turning Points. Get access to daily crossover analysis, real-time confirmation alerts, and learn why the best traders use moving averages to confirm rather than predict.

Conclusion

Moving average crossover strategy works when you understand what crossovers actually do - confirm existing conditions rather than predict future ones. This shift in perspective eliminates the most common crossover mistakes and transforms how you approach these signals. Instead of chasing every golden cross, you wait for complete alignment between trend, timing, and technical confirmation.

The current market environment perfectly illustrates why this matters. Simple crossover signals without context would have you constantly whipsawed by counter-trend bounces within a larger decline. But crossovers viewed through the 3-T's framework help you distinguish meaningful signals from noise.

The next time you see a moving average crossover, resist the urge to immediately enter a position. Ask instead whether this crossover aligns with cycle timing, trend direction, and volume confirmation. More often than not, patience will save you from poor trades while positioning you for the setups that actually work. Remember: crossovers confirm, they don't predict. Trade accordingly.

Author, Steve Swanson